Agflation, is a relatively new term coined by analysts at Merrill Lynch in 2007. Back then rising demand for agricultural products started driving up prices. Agflation is simply a combining of the words agriculture as in “agricultural commodities” and the word inflation. Inflation is commonly used to mean an increase in prices (although it originally meant an increase in the money supply which eventually resulted in an increase in prices). So agflation is simply an increase in the prices of agricultural products.

But agflation is not the result of an increase in the money supply like typical inflation, but rather it is simply a result of supply and demand factors. In 2000, the world wide population was 6,057,000,000 and by the end of 2010 it had increased to 6,900,000,000 or an increase of 843 million. With 843 million more mouths to feed you would expect food prices to increase but during the first five years (through 2005) that had not happened.

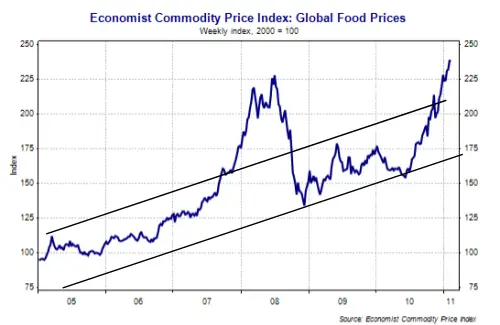

In the year 2000, the Economist magazine’s Commodity Price Index of global food prices was set to equal 100. Five years later the index stood at slightly under 100 a net change over five years of zero (actually a slight decline). As the world population increases the long-term demand for food supplies also increases but as long as the supply of food increases proportionally the price can be expected to remain relatively level as this example shows.

So what happened since 2005 to drive the price of food up 135% over the following five years? Typically you would expect demand for food to be based on consumption, i.e. people eating it, but a major factor in the 2007-2008 spike in food prices was a wholesale conversion of food to fuel. But in 2005 The “U.S. Energy Policy Act” mandated an increase in the use of “renewable” fuels which caused an increase in demand for grains to be converted to fuel (ethanol). Basically the government mandated that in addition to eating our food, we should also burn it.

Then the “Renewable Fuels, Consumer Protection and Energy Efficiency Act of 2007” mandated another increase in the use of ethanol and this drastically increased the demand for corn. You can see the spike in prices in 2008 which was met by farmers increasing production of corn and by the end of 2008 prices were “only” up 25% over 2005 prices. But a variety of factors including the coldest winter in 50 years in food growing places like Mexico have combined to drive prices back up again.

This is similar to the spike in oil prices due to hurricane Katrina shutting down oil wells and refineries in the Gulf. In that case it was a sudden decrease in supply that drove up prices. With agflation it is a “one – two punch”, a sudden increase in demand (2008) due to legislation followed by a sudden decrease in supply due to the weather.

Read more on InflationData.com.